Cryptocurrency trading extends beyond mere numbers and charts; it delves deep into the realm of human psychology. Grasping the psychology of cryptocurrency market analysis can empower traders and investors to make informed decisions, control their emotions, and refine their strategies. In this article, we’ll explore the psychological factors influencing market behavior and how they can affect your trading choices.

Understanding Market Psychology

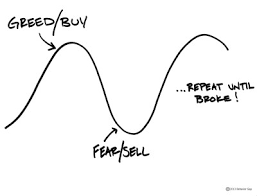

Market psychology encompasses the collective feelings and sentiments of traders and investors, which drive market movements. In the volatile world of cryptocurrency, emotions play a crucial role in how participants respond to market fluctuations. Fear, greed, excitement, and panic can lead to irrational actions, significantly impacting the market landscape.

The Role of Emotions in Trading

The psychology of cryptocurrency market analysis is deeply intertwined with emotional responses. Here are some key emotional drivers to consider:

1. Fear of Missing Out (FOMO)

FOMO can be a powerful motivator, driving traders to buy assets at inflated prices due to the fear of missing potential gains. When a cryptocurrency experiences a rapid price surge, many investors feel pressured to jump in, often without conducting thorough research. This behavior can contribute to market bubbles and lead to significant losses when prices eventually correct.

2. Fear, Uncertainty, and Doubt (FUD)

On the flip side, FUD can lead to mass panic selling. Negative news—whether true or exaggerated—can trigger fear among investors, prompting them to offload their assets quickly. Recognizing the impact of FUD is vital in understanding the psychology of cryptocurrency market analysis, as it helps traders maintain their composure instead of reacting impulsively.

The Herd Mentality

The herd mentality significantly affects the cryptocurrency market. When a large group of people begins buying or selling a particular asset, others often follow, regardless of their independent analysis. This behavior can amplify market movements, leading to cycles of buying and selling that contribute to volatility.

Cognitive Biases in Cryptocurrency Trading

Cognitive biases are systematic patterns of thinking that can skew judgment. These biases play a significant role in the psychology of cryptocurrency market analysis and can influence trading decisions. Here are a few noteworthy biases:

1. Confirmation Bias

Confirmation bias occurs when traders seek information that supports their existing beliefs while ignoring data that contradicts them. For instance, if a trader is convinced a specific cryptocurrency will rise, they may only focus on positive news and dismiss warnings. This selective attention can lead to poor decision-making and financial losses.

2. Anchoring Bias

Anchoring bias refers to the tendency to rely too heavily on the first piece of information encountered. For example, if a trader buys Bitcoin at $60,000 and it drops to $50,000, they might anchor their future decisions to that initial price, failing to adapt to changing market dynamics.

3. Overconfidence Bias

Overconfidence bias can lead traders to underestimate risks and overrate their knowledge and abilities. In the cryptocurrency market, where rapid price shifts are common, this bias can result in excessive risk-taking. Traders may feel invincible after a few successful trades, only to face significant setbacks later.

Strategies to Manage Psychological Factors

While understanding the psychology of cryptocurrency market analysis is crucial, it’s equally important to develop strategies to effectively manage these psychological factors. Here are some practical techniques:

1. Set Clear Goals

Establishing clear and achievable goals can guide your trading decisions and help mitigate emotional responses. Define your investment objectives, such as target profits and acceptable loss thresholds, and stick to them. This clarity can assist you in resisting impulsive actions driven by emotions.

2. Maintain a Trading Journal

Keeping a trading journal allows you to document your trades, decisions, and emotional responses. Analyzing your past performance can reveal patterns in your behavior, helping you make more informed choices in the future. This self-awareness is essential for overcoming cognitive biases and emotional trading.

3. Use Technical Analysis

Incorporating technical analysis into your trading strategy can help minimize emotional decision-making. By relying on data-driven methods—like chart patterns and indicators—you can take a more objective approach to market movements, leading to better-informed decisions.

4. Practice Mindfulness

Mindfulness techniques, such as meditation and deep breathing exercises, can help you manage stress and anxiety related to trading. Staying calm and centered allows for more rational decision-making, reducing the impact of emotions on your trading strategy.

The Importance of Education

Ongoing education is vital for managing the psychology of cryptocurrency market analysis. The more knowledgeable you are about market trends, dynamics, and technical indicators, the better equipped you’ll be to navigate emotional responses. Understanding psychological biases and their effects can empower you to recognize and mitigate their influence.

Staying Informed

Keeping up with market trends and news can help you maintain a balanced perspective. Regularly reviewing analysis reports, following industry experts, and participating in discussions can provide valuable insights that contribute to more rational decision-making.

Conclusion

The psychology of cryptocurrency market analysis encompasses a complex interplay of emotions, cognitive biases, and human behavior. Recognizing these psychological factors is essential for anyone looking to thrive in the volatile cryptocurrency market. By understanding the emotional triggers that can lead to impulsive decisions, you can develop strategies to manage their effects.

By setting clear goals, maintaining a trading journal, utilizing technical analysis, practicing mindfulness, and committing to ongoing education, you can more effectively navigate the psychological challenges of cryptocurrency trading. Ultimately, mastering these psychological aspects of market analysis can lead to better decision-making, improved performance, and a more rewarding trading experience.